Is There a Smarter Way to Invest in Property?

.jpg?width=591&height=591&name=Antony-Cohen-LongView%20(1).jpg)

Antony Cohen, Co-founder & Head of Funds

Published: August 14, 2023

.jpg?width=60&height=60&name=Antony-Cohen-LongView%20(1).jpg)

Antony Cohen, Co-founder & Head of Funds

Published: August 14, 2023

Property is a very attractive asset class

Australian house prices have seen impressive growth over very long periods: the last time that Australian houses fell in value over a period greater than a year was 120 years ago – before Federation. To say that the market has done well in Australia is an understatement. House prices in the eastern capitals have risen consistently at an average rate of more than 7% for decades, withstanding multiple financial crises along the way.

Despite the media commentary focusing on interest rates and housing supply as the key drivers of house price performance, LongView’s whitepapers reveal demographic growth and low urban concentration as the main causes. This is because Australia has unusually high population growth – indeed, the second highest population growth in the developed world – fuelling a constant demand for more housing. Meanwhile, more than half of Australia’s population is concentrated in just three urban centres: Sydney, Melbourne, and Southeast Queensland. Australia’s major cities are also unusually spread out, with most tall buildings clustered in CBDs and low-density suburbs expanding as far as the eye can see.

The result is that well-located residential land, where people can live near jobs, services, and amenities – is in ever-increasingly short supply. Consequently, land value accounts for most of the growth in property value over the last 30 years in Australian capital cities.

But a rising tide does not lift all boats

Asset selection matters. For example, high-density units have grown relatively little, averaging just 1% annually for the past 15 years, even as freestanding houses have grown by more than 7% annually over the same period. This is because most units have significantly less land content than houses. And, when it comes to property growth, land appreciates, but buildings depreciate.

On the other hand, Robust Older Dwellings on Well-Located Land (RODWELLs) can deliver superior capital growth. Because the building is older, its value will have depreciated significantly, meaning that most of the property price is made up of land value, ready to appreciate. But many older houses can make great homes, as long as they are solid buildings and don’t hide any nasties.

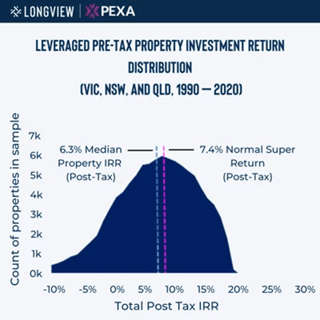

Many landlords in Australia lack this understanding, or the expertise to identify and quickly buy RODWELLs, explaining why our modelling found that 60% of Australian landlords would have been financially better off investing in super.

The ability to negatively gear comes nowhere near compensating for the disappointing capital growth caused by investing in the wrong assets.

Along with the high variability in overall financial returns, being a landlord in Australia’s private rental system presents a range of other challenges. Managing renters can bring lots of headaches, buildings can prove surprisingly expensive to maintain, and unexpected maintenance costs can make a dent in cash flow. All this in an environment of interest rate rises pushing up mortgage payments, and compliance requirements becoming increasingly complex.

No wonder we see clients considering selling their investment property. In fact, across Australia, almost half of all investment properties exit the rental market within five years.

That’s why we developed a smarter way to invest in residential property

LongView has developed a way to access the impressive capital growth residential property can provide, without the headaches of direct investment. LongView Shared Equity Fund does just this, with no risk of increasing interest rates, no tenant hassles, no land tax, and no risk of negative cash flows.

The Fund co-invests with owner occupiers in return for a proportionate share of the capital growth. While participating in the positive social impact of helping first home buyers get onto the property ladder, investors have no requirement to manage tenants, no maintenance headaches, no cash flow shocks from vacancies, or other unexpected costs.

The LongView Shared Equity Fund, which was recently featured in the Australian Financial Review, targets returns for investors of 1.7x-2.1x the House Price Index (net of fees), which would be 12-16% per annum at the average House Price Index of over 7% per annum over the last 40 years.

The Fund allows investors to diversify in a way not possible with direct investment, owning one percent of a hundred properties, rather than one hundred percent of one property. They also benefit from superior asset selection, with properties selected by experts backed by data analytics. This ensures a diversified portfolio of RODWELLs, not properties that run the risk of low growth, or, worse, no growth at all.

If you’re interested in investing in the Fund, please submit the form below.

I'm interested in the LongView Shared Equity Fund

* Source: LongView’s analysis of a $1 million property, including $55k stamp duty and assuming 7% property capital growth and a 5% mortgage rate. Investment returns are calculated as an IRR. For the regular investor return calculations we have assumed an annual income of 1% of the property value which comprises yield income and costs from maintenance, insurance, council rates, vacancy, costs of finding a tenant, and property management fees. Negative gearing and capital gains tax have not been applied to the investor returns. The initial cost associated with finding and settling the property has been set to 1% of the property’s value.

This overview is issued by LongView Funds Management Pty Ltd (ACN 661 659 150) (LongView) as a Corporate Authorised Representative (AR 001302145 of Polar 993 Advisory Pty Ltd (ACN 649 554 932) (AFSL 531197) (Polar Advisory). LongView's authority under its Corporate Authorised Representative Agreement with Polar Advisory is limited to general advice regarding the LongView SE Investment Trust only to wholesale clients. Polar 993 Limited (ACN 642 129 226) (AFSL 525458) (Polar 993) is the trustee of the LongView SE Investment Trust. This overview is provided on a confidential, personal and private basis for use only by the recipient as a wholesale client under the Corporations Act 2001 (Cth) and should not be forwarded to others. The information contained in this overview is of a general nature only and is not to be taken to contain any financial product advice or recommendation. Nothing in this overview is intended as financial product advice and it does not take into account any person’s investment objectives, financial circumstances or specific needs. This overview is neither an offer to sell nor a solicitation of any offer to acquire interests or any other investment and should not be used as the basis for making an investment in the LongView SE Investment Trust. LongView, Polar 993 and Polar Advisory and their directors, officers, employees, agents or associates do not guarantee repayment of capital, the performance of any fund or any service. Past performance is not a reliable indicator of future performance.

.png?width=235&height=55&name=LV%20Logo-02%20(1).png)

-1.webp?width=300&name=PM%202%20(1)-1.webp)

-1.webp?width=300&name=Website%20Hero%20ImagesMortgage%20Stress%20Hero%20(1)-1.webp)

-1.webp?width=300&name=BA%202%20(1)-1.webp)

-3.webp?width=300&name=HEI-1%20(1)-3.webp)

-2.webp?width=300&name=About%20(1)-2.webp)

.png?width=300&height=70&name=LV%20Logo-02%20(1).png)