WHITEPAPER - What drives Australian house prices over the long term?

whitepaper highlights

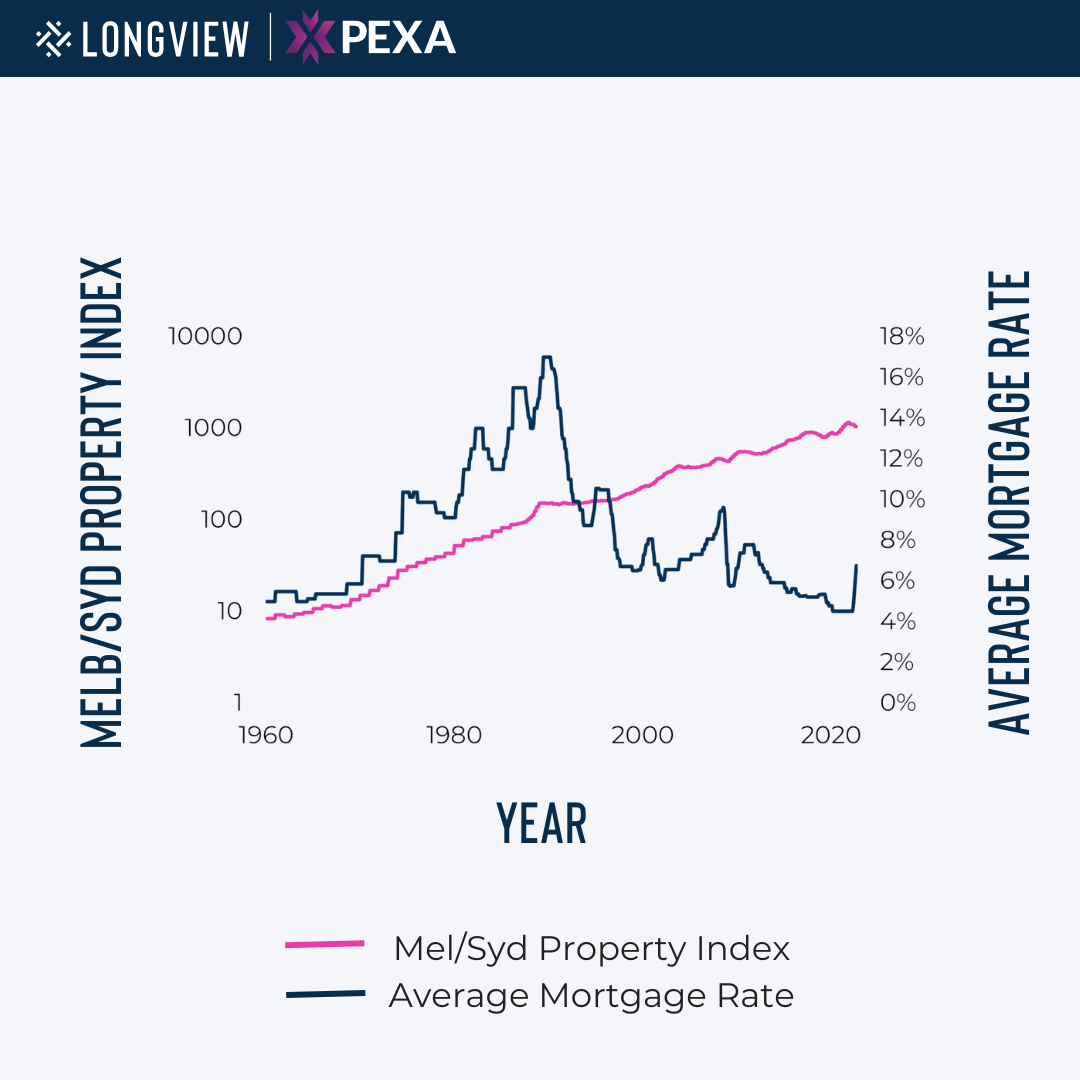

Media commentary on Australian house prices typically focuses on interest rates and tax policies. While both are relevant, they don’t explain most of the growth we’ve seen in Australia over many decades. This Whitepaper snapshot shows how property prices increased substantially during the 30 years of rising interest rates after WW2, as well as in 30 years of falling rates after 1990.

Click here to read LongView and PEXA’s Whitepaper that combines extensive qualitative and quantitative research into the Australian property market to debunk commonly held myths.

.png)

What makes the Australian residential property market so unique?

Nearly every developed country has had record low-interest rates, supply constraints, and government subsidies for housing. What sets us apart is our consistently high population growth rates and urban concentration: 50% of Australians live in Sydney, Melbourne, or Brisbane. Australian cities are also unusual – they are few and large, and have dense CBDs and expansive suburbs, with not much in between.

Australia’s population growth and urban concentration means land has an increasingly important role in house prices. Click here to read LongView and PEXA’s Whitepaper to know more about what drives Australian house prices over the long term.

Is Australia a rental yield or a capital growth market?

Australian property economics are different from those seen in the rest of the world. For example, in the US, most investment returns on property come from rental yield, and little from capital growth, but in Australia the opposite is true. That’s why we see apartment prices growing much more slowly than detached house prices.

Want to know why Australian house prices grow faster than almost any other country in the world?

Click here to LongView and PEXA’s Whitepaper to find out.

.png)