Property Market Update

Tim Beasley

COO

Property prices continue to rise despite adversity

The modest uplift in national property prices has persisted over the last two months, rebounding further from the beginning of this year. The pace of these gains gained further momentum in May. Sydney prices have increased by 4.6% over the last quarter, followed by more moderate gains in Brisbane (1.8%) and Melbourne (1.6%).

However, despite these recent gains, housing values are still well below their peaks last year: Sydney is -9.6% vs. January 2022, Brisbane is -9.4% vs. June 2022, and Melbourne is -8.2% vs. February 2022.

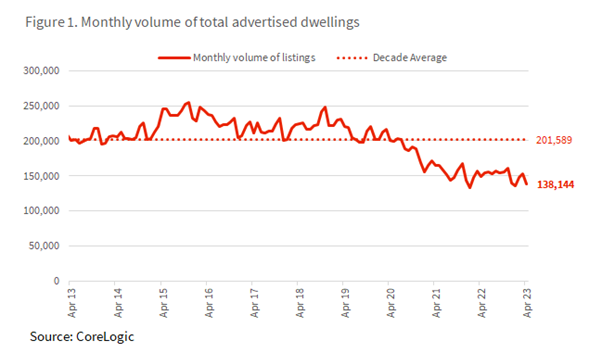

As mentioned in previous updates, one of the major factors this year has been the low level of advertised listings. This trend continued in May, with approximately 1,800 fewer capital city homes advertised for sale compared to the end of April. Inventory levels are now 15% lower than they were at the same time last year and 24% below the previous five-year average for this time of year.

Due to the limited housing stock available, buyers are becoming more competitive, resulting in higher auction clearance rates, which are holding at 70%+. With selling conditions improving and the full impact of increasing rates yet to be fully felt, it is possible that more properties will enter the market.

However, new listings usually remain subdued during winter before trending higher in spring. If the market continues its recent upward trajectory, historical patterns suggest that listing volumes will increase, which may be further amplified by the current low inventory levels.

Rental Market performance remains strong

In the rental market, prices are continuing to increase rapidly. Sydney unit rents have risen by 5.7% over the past three months, followed by Melbourne (5.2%) and Brisbane (3.8%) over the rolling quarter. The increased demand for higher-density rental accommodation, driven by the return of foreign students and overseas migrants, particularly in regions popular with recent migrant arrivals, contributed to this trend.

The impact of interest rate rises

With a recent increase in interest rates and the Reserve Bank of Australia (RBA) signalling further hikes in the coming months, the market may have underestimated the extent of the current interest rate hiking cycle. Furthermore, as mentioned in previous updates, the upcoming months will see a significant rise in the number of fixed-rate home loans reaching term. As more borrowers refinance, a better understanding of their ability to service debt at substantially higher interest rates will emerge. It would be naïve to think this won’t impact the housing market.

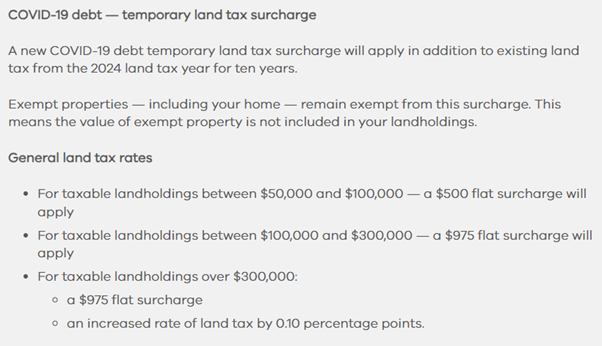

“Temporary” land-tax surcharge introduced in Victoria

The last month also saw the Victorian State Government budget handed down, including a “temporary” land-tax surcharge.

So, despite low stock volumes across the market, we have seen a twofold increase in enquiries from our clients requesting appraisals of their properties and considering their options. Similarly, on the flip side, we have had record low levels of investor buyer advocate mandates this year. From where we sit, it appears investors are heading (or considering heading) for the exit. This is also one of the reasons why LongView has launched an alternative residential property investment option via our Shared Equity Fund, which avoids the impacts of interest rate increases, land tax, and additional tenancy compliance regulations.

As always, we’re here to help with any of your property needs, so please don’t hesitate to contact me or any of our team members.

.png?width=235&height=55&name=LV%20Logo-02%20(1).png)

-1.webp?width=300&name=PM%202%20(1)-1.webp)

-1.webp?width=300&name=Website%20Hero%20ImagesMortgage%20Stress%20Hero%20(1)-1.webp)

-1.webp?width=300&name=BA%202%20(1)-1.webp)

-3.webp?width=300&name=HEI-1%20(1)-3.webp)

-2.webp?width=300&name=About%20(1)-2.webp)

.png?width=300&height=70&name=LV%20Logo-02%20(1).png)