Property Prices continue to rise, but Melbourne is lagging behind the other majors

Property Prices continue to rise, but Melbourne is lagging behind the other majors.

Tim Beasely, COO

Published: October 13, 2023

Tim Beasely, COO

Published: October 13, 2023

Property Prices continued their eighth straight month of price growth with every capital city, except for Hobart, recording positive gains over the last Quarter. Based on the current pace of growth rates, it’s likely that national house prices will reach new records highs in early 2024, with Brisbane set to reach new record highs this month.

Of the three major eastern seaboard capitals, Sydney and Brisbane are leading the price recovery growing 2.5% and 3.9% respectively in the last quarter vs. 1.3% in Melbourne. Indeed, what sticks out most when reviewing price rises this year, is the underperformance of Melbourne relative to Sydney and Brisbane.

Indeed, looking at how much property prices have increased in each of Melbourne, Sydney, and Brisbane since bottoming out in each respective city (see chart below), Melbourne has severely underperformed, increasing at half the rate of Brisbane and Sydney.

So, what is driving the underperformance in Melbourne?

The short answer is that it’s not overly clear as to what is exactly driving the underperformance as the core fundamentals; being the rate of population growth, economic and employment conditions and advertised listings are all relatively consistent across the three cities.

One possible partial explanation is that Net Investor Participation (that is the number of investors buying vs. selling) is falling in Victoria. Many readers won’t find this point surprising given the overall negative property owner sentiment driven by the Victorian Government – notably new land-taxes, additional compliance regimes and further tenancy regulation. The proportion of property listings which are assumed to be investor owned is running at approximately 50% higher than the pre-Covid average (see below).

Meanwhile, the percentage of investor loans as a proportion of all new mortgages (which is a good proxy for the number of new investors entering the market) has increased from record lows to be around 31% of all new home-loans over the last quarter but is still significantly below that of the numbers of investors selling. On our calculation for every 6 investors selling, 5 are buying, a 16% reduction in investor participation.

So, whilst the above is clearly one factor weighing the price recovery in Melbourne, it’s unclear how much this alone is contributing to the overall underperformance relative to Sydney and Brisbane.

Price Movements across suburbs are not consistent.

Unsurprisingly areas in the growth corridors of Melbourne, which are more likely to be negatively impacted from rising interest rates given higher average mortgage levels, have experienced modest price reductions whereas areas in inner Melbourne and in Melbourne’s “leafy” east are experiencing modest to strong price increases (see below)

New Stock is rising but for now appears to be being fully absorbed.

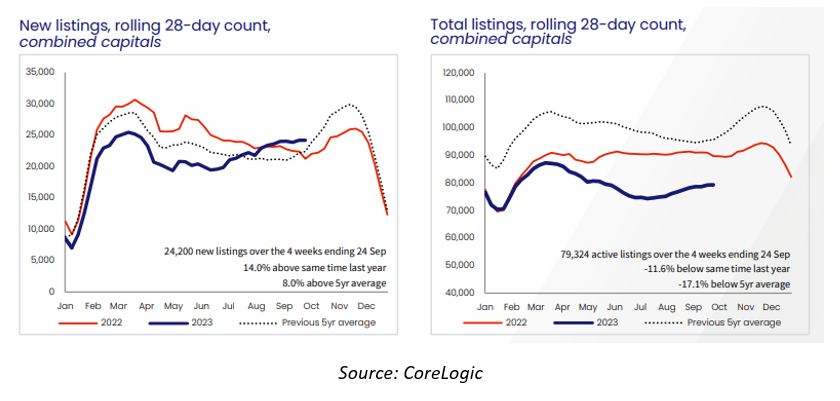

New listings have continued to trend higher (about 6% above the 5-year average but slightly lower than at the same time last year). Listings have risen due to a combination of more stock being added to the market, but are being absorbed quickly meaning that total listings remain below levels last year and well below the 5-year average.

Vacancy rates remain low, and as a result, rents continue to rise.

Average rental prices in Melbourne continue to rise, with median rents across all of metro Melbourne increasing 15% annualised over the last quarter. This is the same rate as the last 12 months. In other words, the pace of rental price growth is not yet slowing, despite a very modest uptick in vacancy from 1% at the start of the year to 1.3% in September.

In Brisbane, it appears that there has been an uptick in the growth rate of median rents, with an annualised increase of 14% over the last quarter, whereas median rents were flat between January and May this year. This may be explained by a modest reduction in Brisbane vacancy rate by 0.1% in August.

.png?width=235&height=55&name=LV%20Logo-02%20(1).png)

-1.webp?width=300&name=PM%202%20(1)-1.webp)

-1.webp?width=300&name=Website%20Hero%20ImagesMortgage%20Stress%20Hero%20(1)-1.webp)

-1.webp?width=300&name=BA%202%20(1)-1.webp)

-3.webp?width=300&name=HEI-1%20(1)-3.webp)

-2.webp?width=300&name=About%20(1)-2.webp)

.png?width=300&height=70&name=LV%20Logo-02%20(1).png)