Governments are sending mixed messages to property investors

![]() 4 MIN READ | By Tim Beasley | October 31, 2024

4 MIN READ | By Tim Beasley | October 31, 2024

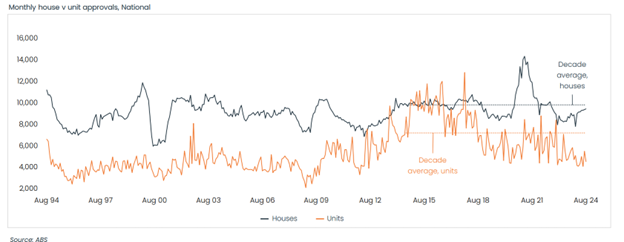

Supply, supply, supply – As 2025 and the next federal election approaches, we’ve been hearing lots about it from every major Australian political party. Whether it be the Federal government’s National Housing accord of 1.2million homes over 5 years or the Victorian government swiftly changing density limits and setting local governments ambitious housing supply targets (aka subdivision and development targets). Despite all the noise, most industry experts agree that these targets are unlikely to be met. Housing approvals across the country are falling with both detached houses and unit approvals below their decade average levels.

Of course, housing supply can only work if there’s a functioning development and construction sector, which is currently facing numerous challenges. The most significant being persistent labour and materials costs increases which has squeezed margins considerably. This is evidenced by over 3,000 building companies entering some form of administration or insolvency in FY24.

Approximately a third of all new housing is purchased by investors and as we’ve extensively written, the conditions for property investors have deteriorated significantly in recent years. This is most notable in Victoria, with increasing land tax, including for the first time apartment owners, and tenancy regulation burdens. Unsurprisingly, investor sentiment in Victoria is poor, with many deciding to exit the market.

Recently, the federal government has again floated the idea of reviewing negative gearing and the capital gains discount. This has further clouded the horizon for property investment, leaving investors without regulatory certainty.

Pushing in the opposite direction, the Victorian Government just announced significant stamp duty concessions for any purchases of new apartments (including investors). However, this policy’s impact is yet to be fully apparent as Victoria has areas where there is already oversupply of apartments.

The oversupply has led to new build apartments delivering poor investment returns in comparison to older established dwellings and even compared to new build detached homes. We witness this every day in conversations with our clients and it is confirmed by the analysis of our in-house data analytics team.

The mixed messaging from the Victorian and Federal Governments could be interpreted by property investors as pushing the accelerator and the brake at the same time. On the one hand, setting ambitious targets, relaxing zoning and offering stamp duty concessions is stimulatory. On the other hand, increasing land taxes and regulatory costs is contractionary.

Whilst the picture for property investors entering the market looks mixed, no such headwinds exist for homeowners. With two thirds of the country owing their own home, no Government has the appetite to contemplate changing the complete tax-free status of the family home (both land-tax or capital gains).

The LongView Shared Equity Fund deliberately set out to co-invest alongside homeowners to benefit from their land tax exemption status. Without any other holding costs (e.g. maintenance, rates or strata charges), the result is a better financial return to fund investors on the exact same properties compared to if they were held directly by a property investor.

More from...

How is your property performing?

Explore why understanding the true performance of your property investments is crucial, and discover how strategic portfolio reviews can help you make informed decisions that significantly impact your financial future.

Read More

Why are so many landlords selling? Is there a better way?

Increasing number of landlords selling their properties in Australia. Rising land taxes, interest rates and tenant headaches are the top reasons. Is there a better way to invest in property?

Read More

How to access equity in your home

There are many financial products on the market for accessing equity in your home, but it's important to find one that best meets your needs and life circumstances.

Read More.png?width=235&height=55&name=LV%20Logo-02%20(1).png)

-1.webp?width=300&name=PM%202%20(1)-1.webp)

-1.webp?width=300&name=Website%20Hero%20ImagesMortgage%20Stress%20Hero%20(1)-1.webp)

-1.webp?width=300&name=BA%202%20(1)-1.webp)

-3.webp?width=300&name=HEI-1%20(1)-3.webp)

-2.webp?width=300&name=About%20(1)-2.webp)

.png?width=300&height=70&name=LV%20Logo-02%20(1).png)