property market update

Tim Beasley

Chief Operating Officer

Is the Australian housing downturn over?

The Australian housing market appears to have turned a corner, with dwelling values increasing for the second consecutive month in April 2023. Sydney is leading the positive trend, with housing values rising each month since February and prices now 3.0% higher than the recent low recorded in January. The four largest capital cities have all seen a rise in housing values over the rolling quarter, suggesting that the market may have turned.

.png?width=800&height=437&name=MicrosoftTeams-image%20(12).png)

There is a worsening imbalance between supply and demand. Persistently low levels of advertised supply have been a key factor supporting housing values. The flow of newly listed properties has remained below the previous five-year average since September last year, with the rolling four-week trend holding around -14% below the average for this time of the year towards the end of April.

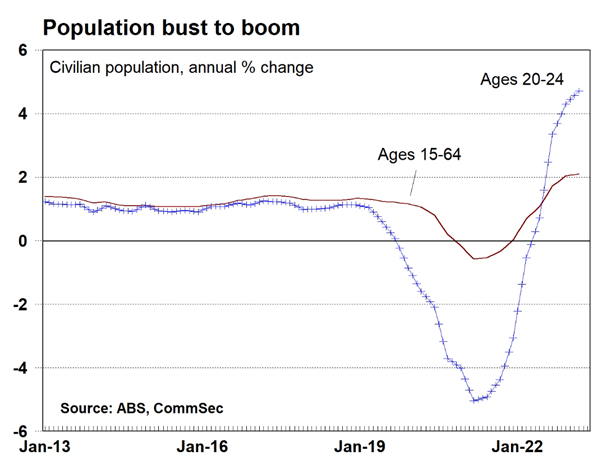

This lack of housing supply has been accompanied by a significant increase in net overseas migration. Based on ABS and Commsec’s data, over the past year, Australia's population over 15 years of age has grown by 523,200 or 2.3%, the fastest growth rate in 14 years. While overseas migration would normally have a more direct correlation with rental demand, with vacancy rates holding around 1% in most cities, it’s reasonable to assume many people are fast-tracking purchasing.

Another likely factor supporting housing demand is the growing expectation that the rate-hiking cycle is over or nearly over following a sharp decline in values. As interest rates stabilise, there is a good chance that consumer sentiment will improve, bolstering housing market activity from both a purchasing and a selling perspective. The last time housing values trended higher through a rising interest rate environment was during the mid-to-late 2000s, when the mining boom was underway. This period was also characterized by surging net overseas migration.

While the outlook for housing is looking more positive, it’s important to acknowledge some of the headwinds that are likely to offset material momentum building. While interest rates have either peaked or are close to peaking, the cost of debt remains 105 basis points above the pre-COVID decade. The combination of a high cost of debt and high debt levels, as well as cost of living pressures, is likely to keep sentiment at below-average levels, at least until interest rates come down.

Additionally, as we have previously highlighted, we are yet to see the full impact of the rapid rate-hiking cycle flow through. As more borrowers roll off very low fixed-term rates onto variable rates (which are three times higher), more distress is likely to occur, including a rise in mortgage arrears (albeit from record lows) and potentially a lift in motivated listings.

As always, our team is here to help you make informed decisions and avoid costly mistakes, whether you are buying or selling a property. If you’d like advice on what all of this means for you or your property, please do not hesitate to reach out to myself or any of our team.