WHITEPAPER - Mobilising Private Capital for New Housing Solutions

Our third and final Whitepaper, published with PEXA, examines four models that can work at scale to address Australia's housing crises. It combines extensive qualitative and quantitative research into the Australian property market and draws on LongView and PEXA’s deep experience in the property sector.

whitepaper highlights

It is easy to underestimate the scale of housing in Australia. Housing affects all of us. Each year, nearly 140,000 Australians buy their first home. Australia has more than 2.2 million landlords, with more than 2.9 million households renting in the private rental system. With a total value of $9.8 trillion, the housing market dwarfs all other asset classes and aggregations.

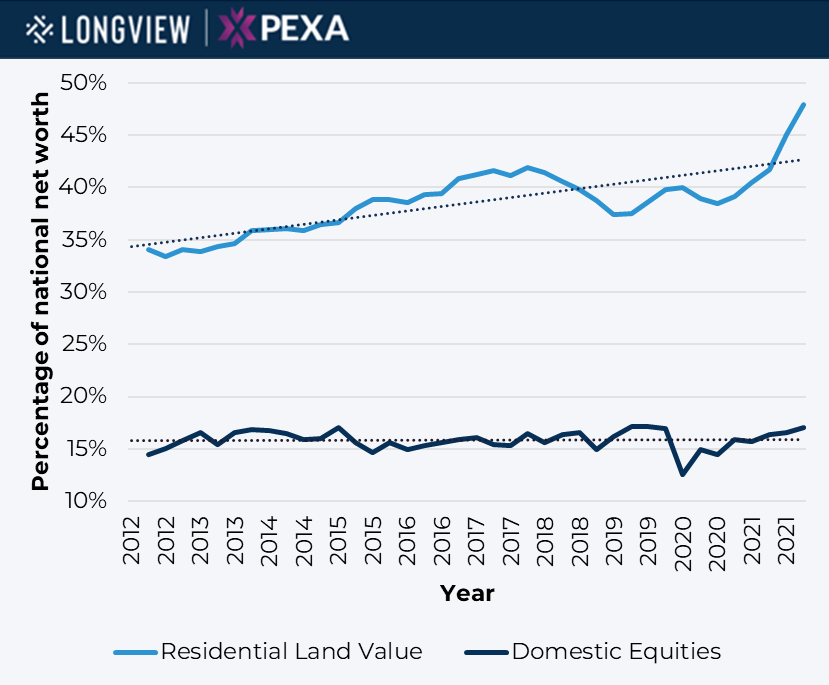

Properties in Australia capital cities have on average grown by 7.2% annually over the last 50 years. This annual change in property prices is equivalent to a third of Australia’s total GDP each year. In comparison, the Federal Government will spend just $3.5B on housing this year – 30 years of government spending combined would amount to just 1% of the total value of house prices. Residential land alone (not including housing sitting on that land) now accounts for more than 50% of Australia’s national assets, up from just over 30% in 2012, while the total value of domestic equities hovered between 14% and 18% as a proportion of total assets over the same period.

When discussing private investment in Australia, most of the discussion, and certainly most policy emphasis, is placed on institutional investors – notably large superannuation funds. The Federal Government has recently announced a major push to work with superannuation funds to engage with the Australian housing sector, as they currently have very little exposure to Australian residential property (particularly considering their size and the size of the asset class).

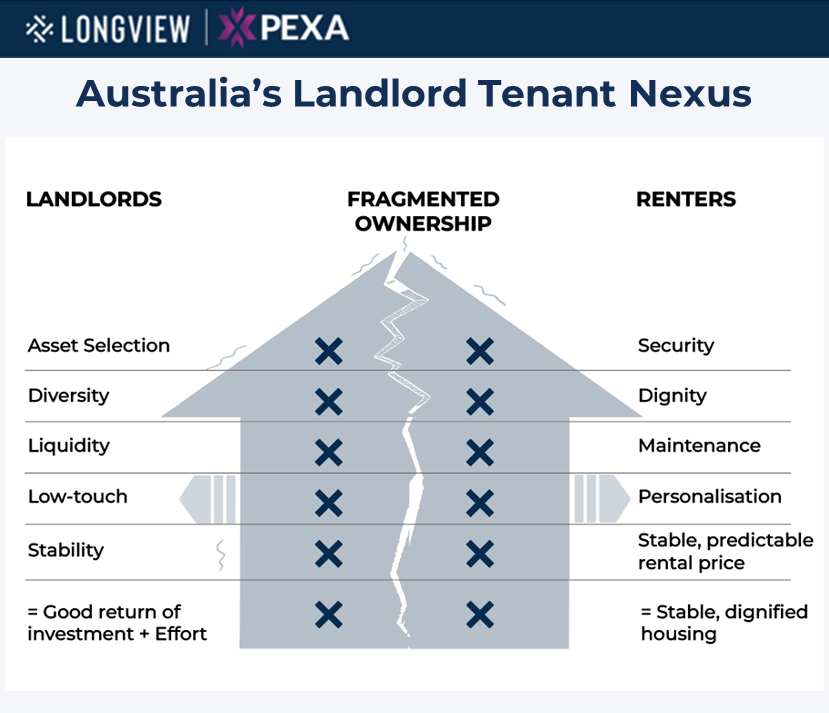

But a much larger source of capital also lies in Australia’s mum and dad investors, where Australia’s two million individual landlords account for ownership of 26% (approximately $2.5T) of Australia’s $9.8 trillion residential property market and, unlike superannuation funds, have already chosen the residential property asset class. This group also stands to benefit the most from redefining Australia’s landlord-tenant nexus.

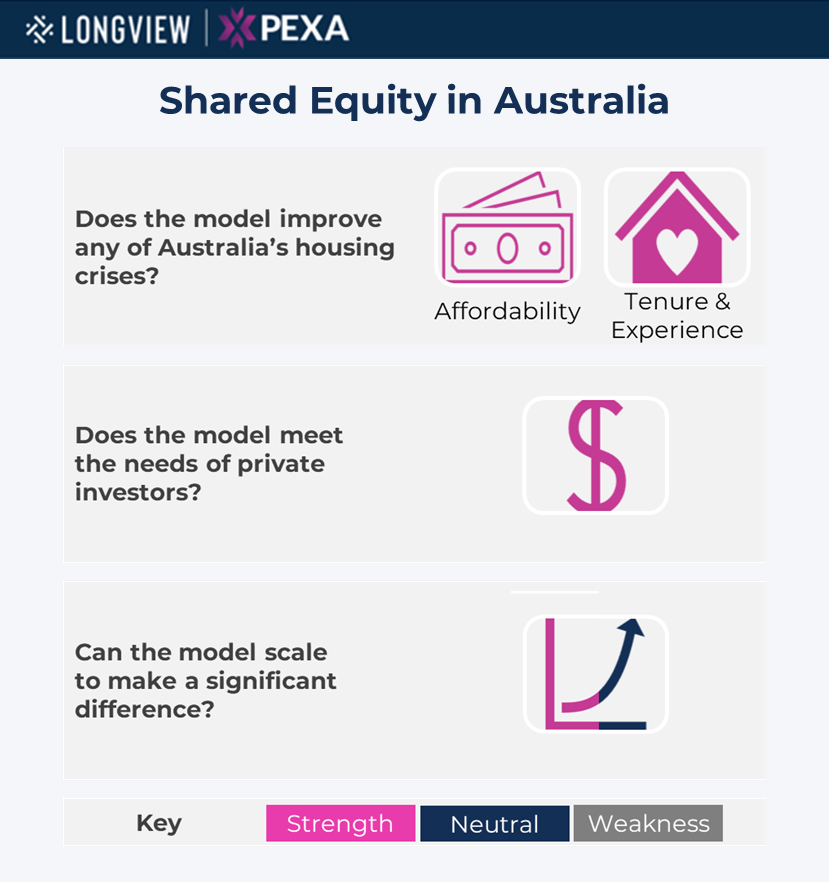

Shared Equity models involve a third-party investor co-investing in a property with a homeowner in exchange for a share of a property's capital growth. Shared Equity programs enable buyers to buy properties with lower deposit savings. They can also result in lower monthly mortgage payments, allowing owners to share financial risk with third parties. Shared Equity programs exist in Australia at both State and Federal government level. The model has an extensive history overseas, mostly funded by governments to improve housing affordability, but also by private sector organisations to achieve commercial outcomes.

Privately funded Shared Equity models are a compelling solution to Australia's purchase affordability crisis because they improve the accessibility of homeownership. They can offer good returns to investors because they provide good exposure to capital growth, the core component of returns in Australian housing markets.

Everyone wants to be able to have the security of a good home, a place they can treat like home, rely on like home, that feels like home. Australian homeowners take these things for granted, but Australian renters don’t have a place that feels like a real home. Instead, they often live under constant threat of upheaval, poor maintenance, and service, and can feel pushed around in their own homes.

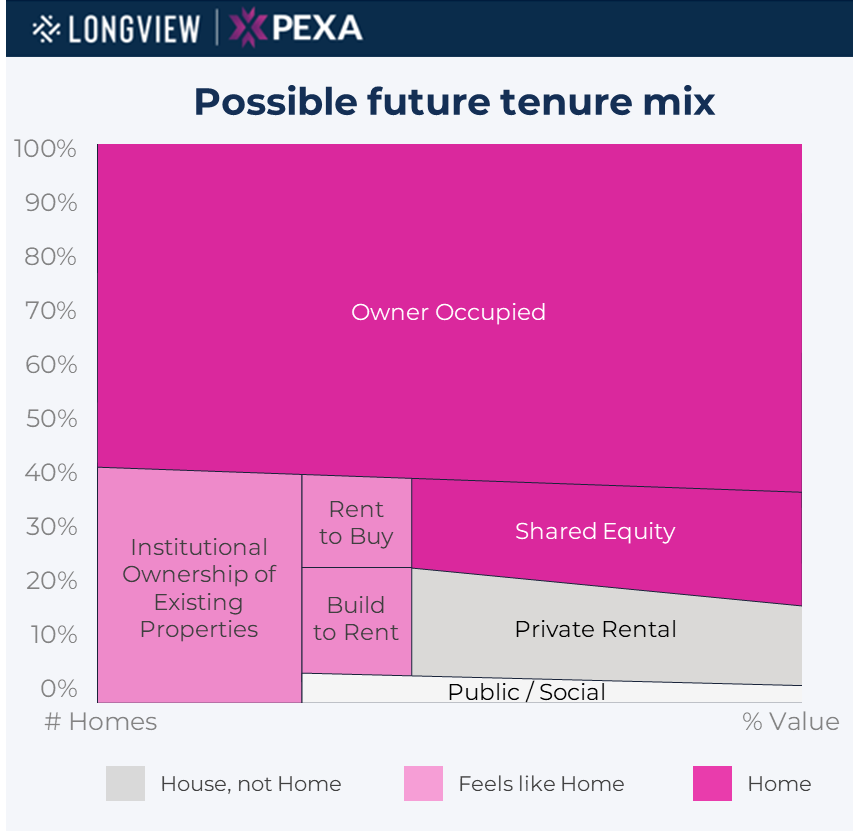

The four models analysed in this report (Shared Equity, Build to Rent, Institutional Ownership, and Rent to Buy) offer the possibility of getting renters out of renting into owning, and where that isn’t possible, into a much better model of renting which is dignified, secure, flexible, and feels like home.

For more information about this whitepaper, contact Jane-Frances Kelly

.jpg?width=300&name=Jane-Frances-Kelly-LongView%20V2%20(1).jpg)