Rental Market Update

Danielle clark

General Manager - QLD

.jpg?width=200&height=200&name=Megan-Taylor-LongView%20(2).jpg)

megan taylor

Head of Property Partnerships

Why have qld rents soared by 41% in the past 18 months?

Historically, the rental market in Australian capital cities has closely followed inflation. However, this was not the case over the last two years, when the Covid-19 pandemic threw conventional wisdom out the window for several industries – from computer chips to toilet paper.

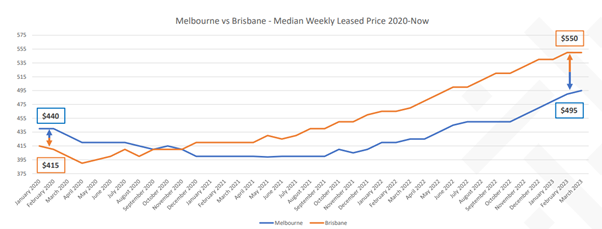

Brisbane and the greater Southeast Queensland corridor have been by far the best-performing rental market of our big three metro areas. The region suffered minor negative rental pricing at the start of the pandemic, before a sustained period of growth over the last three years. In those areas, the median price has increased from a low of $390 to now more than $550 (41% increase).

To put this into perspective, let’s compare the median price of Melbourne vs. Brisbane: before the pandemic, Melbourne had a median rental price $25 higher than Brisbane, whereas now Brisbane is $55 higher than Melbourne.

Much of this was spurred on by Brisbane and Southeast Queensland benefitting greatly from net interstate migration during extended lockdowns in southern states. In our view, it’s unlikely that this gap between Melbourne and Brisbane will persist, as international migrants and students are more likely to reside in Melbourne and Sydney. We are already witnessing this with the early signs of rental prices slowing in Brisbane, whilst they remain strong across metro Melbourne and Sydney. With that said, Melbourne prices would have to grow another 11% just to get back to par with Brisbane – assuming Brisbane prices remained flat during that period.

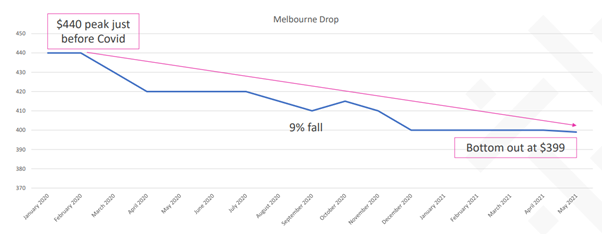

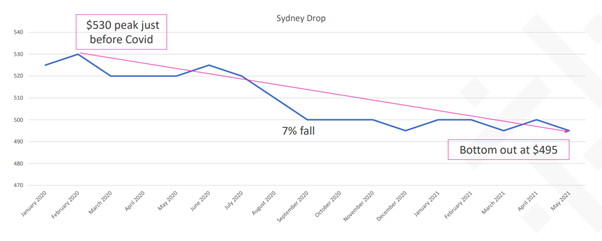

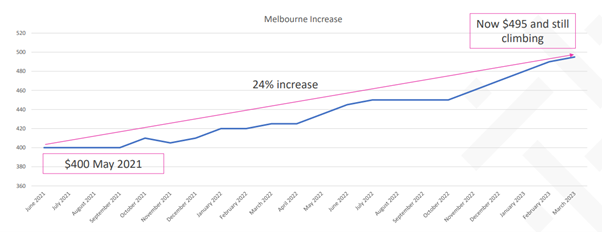

In Melbourne, which endured the worst of lockdowns and suffered from net interstate emigration, the rental market suffered the first-ever sustained period of significant rental decline. Over the course of 2020 to mid-2021, Melbourne rents declined 9%, with Sydney falling 7% over the same period.

This decrease was motivated by three factors:

- International students and foreign residents returning to their country of origin.

- A large number of properties previously listed on short-term platforms such as Airbnb moving back onto the long-term rental market.

- Household consolidation driven by younger people and those working in severely impacted industries (hospitality, travel, retail) moving back in with parents and/or housemates.

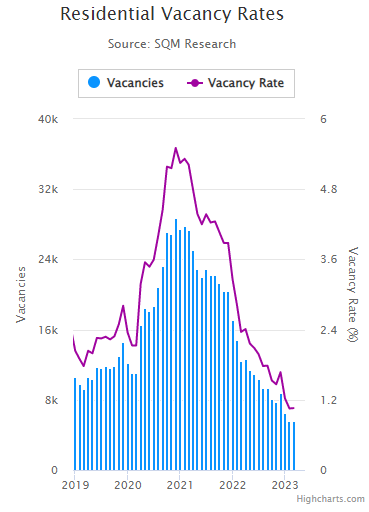

As a result, the total number of available properties for lease grew, with vacancy rates tripling and prices rapidly declining at the start of the pandemic.

As disposable cash savings increased (driven primarily by government-related stimulus), and as the impacts of the pandemic have eased and our borders re-opened, the above drivers are now playing out fully in reverse:

- The number of properties listed on short-term platforms is reaching all-time highs.

- Household consolidation has reversed, as people quickly valued more space.

- The immigration and international student floodgates have opened, with net migration tipped to exceed 300,000 people this financial year.

Consequently, the capital cities now experience all-time low vacancies of less than 1%, a drop of 80% compared to the peak of the pandemic.

Accordingly, rental prices in Melbourne and Sydney have seen a significant surge in the past 18 months. Sydney rents have soared by 26%, followed by 24% in Melbourne, with sharp upticks in the previous six months. However, even with these notable increases, Melbourne's rental prices are only about 10% higher than pre-Covid levels, which is lower than inflation during the same period.

What does all of this mean for property owners?

If you have a vacant property, our advice is to be pricing it at or above rates advertised online, especially in inner-city pockets of metro Melbourne and Sydney. It’s also worth noting that whilst the market overall is increasing, this is not necessarily true for all areas and properties. For example, houses in new estates far from CBDs are increasing at lower rates than inner city areas, in the same way that they declined less during the height of the pandemic. So, whilst our advice is to aim high for vacant properties, this needs to be done in recognition that the price may need to come down over a leasing campaign if adequate interest is not generated at the initial advertised pricing.

For lease renewals, the situation is more complex. The truth is that many renters cannot afford the type of increases we are currently witnessing in the marketplace for the current property they are leasing. Our team is ensuring that we adequately communicate current market conditions with our renters so that they are informed before any increase is issued. There is unlikely to be any immediate respite from rental prices increasing even further from where they are today, most notably in Melbourne and Sydney. Therefore, a property with a market rent that is currently unaffordable for a renter is likely to be even more unaffordable in 6-12 months. The situation in Brisbane is slightly different, with rental price growth appearing to be softening, in which case there is likely a premium on retaining an existing tenant.

Ultimately each situation is different with existing renters and it’s best to discuss with your property manager what the right balance is given the renters’ situation and history, your own personal situation and movements in the market.

Finally, it would be remiss of us not to mention the ongoing demands from both renter advocacy groups and others for Government intervention in the rental market. Whilst most ideas that have been floated, namely introducing a “rental freeze”, would almost certainly exacerbate the issue, we believe the demand for action by Governments is only going to get louder as this issue gets worse. So, it is naive to think that action, whether effective or not, will not happen. Short of putting a freeze on migration (which would have many other consequences, namely on important economic divers and addressing labour shortages), there are few short-term levers that Governments call pull. We recently outlined many of the causes of these issues in our published whitepapers. As we outline in these papers, issues that have been decades in the making are unfortunately going to take decades to rectify. The one obvious area of Government intervention may be in the restricting supply of short-term rental accommodation. There is already mounting pressure for Governments to act on this issue. This would provide some temporary relief in terms of rental price growth, given there are approximately 1.5X as many properties listed on Airbnb than there are on the long-term rental market. In theory, this could more than double the amount of rental stock available, however, not all properties listed on short-term are suitable or would be made available for long-term renters.

Navigating this market is a top priority for our team. That is why we combine all the facts and information from the industry’s only in-house data science team with our property management team’s on-the-ground experience. As we did during the height of the pandemic, being rated the fastest agency to lease a property in Melbourne, this approach ensures we get the best outcomes for our clients.

If you have any questions about the current market or its impact on your property, please reach out to our team.

.

Know the value of your investment.

Know your property's true value with our rental appraisal which is full of the practical advice you need to start making a healthy profit on your investment property.