FUNDS MANAGEMENT

LongView Homes Investment Fund 1

Fund Overview

Access investment-grade products in Australia's largest asset class

LongView Homes Investment Fund (“The Fund”) provides investors with access to investment-grade products in Australia’s largest asset class, Australian Residential Property. This asset class is estimated to be worth ~$9.5 trillion, more than three times the size of domestic equities.

The Fund is targeting returns of 1.7x to 2.1x (net of fees and costs) the Housing Price Index.

.png?width=246&height=250&name=MicrosoftTeams-image%20(250).png)

Help solve the crushing social problem of housing affordability for those with no “bank of Mum and Dad"

The Fund solves the "deposit gap" for the 1/3 of a generation who don't have the "Bank of Mum & Dad". By co-investing with homebuyers in high-capital growth properties, our investors share in the levered equity returns and preferential tax treatments of the homeowner. The Fund will co-invest with Clients in selected Australian residential property primarily via the LongView Buying Boost Product.

LongView Homes Investment Fund allows investors to:

- Invest in existing residential property with diversification at scale

- Invest alongside homebuyers to get them the deposit they need to buy a better home, sooner

- Materially outperform the housing index by accessing the leverage and land tax advantages of the homeowners to generate stronger returns than direct ownership on the exact same asset

- Access enhanced returns through superior asset selection driven by data science and decades of field expertise

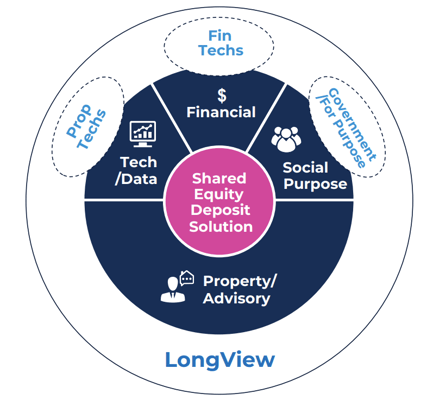

Shared Equity is emerging as the next generation of home finance, and LongView is the blue chip player

LongView has a diverse group of 90 professionals with decades of experience in

• Residential property services

• Residential property investment

• Tech & data analytics

• Social ventures

• Funds management

Our comprehensive capabilities position us as the blue chip player in Shared Equity. You can find out more about our team here.

Register your interest in the LongView Homes Investment Fund

Australia has some of the best capital growth residential markets in the world, but this also means yields are low.

Land appreciates, and building depreciates. Our data scientists have analysed millions of individual properties and their sale prices over 50 years. While every property must be assessed individually, one general theme dominates if you wish for superior capital growth - buy Robust Older Dwellings on Well-Located Land.

INVESTMENT PHILOSOPHY

Our Investment Philosophy is based on three key elements:

1. The asset class: Australian Residential Property

3. Asset selection matters: RODWELLs deliver superior capital growth

1. The asset class: Australian Residential Property

Consistent Price Growth: Australian house prices have consistently climbed over long periods (doubling 7 times in 6 decades) whether interest rates have risen, fallen or stayed flat.

Composite Sydney and Melbourne house price index vs. mortgage interest rates

.png?width=774&height=386&name=MicrosoftTeams-image%20(215).png)

-1.png)

Capital over Yield: Australia has some of the best capital growth residential markets in the world (and thus low yields), so targeting capital growth is key to returns and thus targeting well located land component is the focus.

Growth vs. yield of residential property in selected markets over 35 years

.png?width=774&height=382&name=MicrosoftTeams-image%20(214).png)

Population growth driving land value: High capital growth has been driven by the impact of population growth on suburban land values. Australia’s population growth is among the highest in the world and has been for sustained periods.

Average population growth of comparable OECD countries 1982 - 2022

.png?width=774&height=341&name=MicrosoftTeams-image%20(213).png)

2. Shared Equity: An alternative to direct investment in property, addressing the home affordability gap

Shared Equity as a solution for the home affordability gap

Housing affordability is a large and growing problem for a significant proportion of the Australian population.

We estimate that the time taken to save the deposit required to buy a home has increased over time and is now typically over a decade. This timeframe makes home ownership increasingly inaccessible for those without assistance from Governments or the “bank of Mum and Dad”.

In broad terms, shared equity is where a homebuyer shares the capital cost of purchasing a home with an equity partner, thereby allowing the homebuyer an ability to purchase a better home sooner. The LongView Buying Boost Product is a form of shared equity designed to bridge the home affordability gap for those who don’t have access to the “bank of Mum and Dad” and are not eligible for Government schemes.

LongView expects that a large proportion of its Clients will be migrants, children of migrants, sole parents and children of sole parents, children of renters and “re-builders” who have, at one time, owned a home but have lost the home (or it has been diminished) through divorce, disability or business failure. We believe that there is a strong social benefit in enabling secure housing for all such cohorts.

Shared equity will outperform direct investment for the exact same property

The Fund shares in the levered equity returns and land tax exemption of home buyers. Investment through Shared Equity will outperform direct investment in the exact same property because of higher gearing and lack of Land Tax.

Example returns from a single property - Direct vs. Shared Equity investment*

3. Asset selection matters: RODWELLs deliver superior capital growth

Our data scientists have analysed millions of individual properties and their sale prices over 50 years. While every property must be assessed individually, one general theme dominates if you wish for superior capital growth – land appreciates and buildings depreciate. This makes Robust Older Dwellings on Well-Located Land (RODWELLs) the ideal housing type when pursuing strong capital gains.

Our data and analytics capabilities, coupled with our field expertise, allows us the capabilities to screen, identify and secure RODWELLs to co-invest with alongside homebuyers.

.jpeg?width=700&height=408&name=iStock-985940756%20(4).jpeg)

Register your interest in the LongView Homes Investment Fund

FUND ADMINISTRATION & FIELD DELIVERY

INVESTMENT COMMITTEE

I'm interested in the LongView Homes Investment Fund

1) "LongView Homes Investment Fund" refers to the LongView Shared Equity Investment Trust.

* Source: LongView’s analysis of a $1 million property, including $55k stamp duty and assuming 7% property capital growth and a 5% mortgage rate. Investment returns are calculated as an IRR. For the regular investor return calculations we have assumed an annual income of 1% of the property value which comprises yield income and costs from maintenance, insurance, council rates, vacancy, costs of finding a tenant, and property management fees. Negative gearing and capital gains tax have not been applied to the investor returns. The initial cost associated with finding and settling the property has been set to 1% of the property’s value.

This overview is issued by LongView Funds Management Pty Ltd (ACN 661 659 150) (LongView) as a Corporate Authorised Representative (AR 001302145 of Polar 993 Advisory Pty Ltd (ACN 649 554 932) (AFSL 531197) (Polar Advisory). LongView's authority under its Corporate Authorised Representative Agreement with Polar Advisory is limited to general advice regarding the LongView SE Investment Trust only to wholesale clients. Polar 993 Limited (ACN 642 129 226) (AFSL 525458) (Polar 993) is the trustee of the LongView SE Investment Trust. This overview is provided on a confidential, personal and private basis for use only by the recipient as a wholesale client under the Corporations Act 2001 (Cth) and should not be forwarded to others. The information contained in this overview is of a general nature only and is not to be taken to contain any financial product advice or recommendation. Nothing in this overview is intended as financial product advice and it does not take into account any person’s investment objectives, financial circumstances or specific needs. This overview is neither an offer to sell nor a solicitation of any offer to acquire interests or any other investment and should not be used as the basis for making an investment in the LongView SE Investment Trust. LongView, Polar 993 and Polar Advisory and their directors, officers, employees, agents or associates do not guarantee repayment of capital, the performance of any fund or any service. Past performance is not a reliable indicator of future performance.

.png?width=425&height=600&name=MicrosoftTeams-image%20(216).png)